Introduction

In the modern world, digital payments have emerged as a transformative force, reshaping the financial landscape. The advent of digital financial services has created unprecedented opportunities for financial inclusion, enabling millions of people worldwide to access banking services that were previously unavailable to them. Digital payments facilitate economic participation, enhance financial literacy, and empower marginalized communities by offering secure, efficient, and convenient financial solutions.

This article explores the role of digital payments in advancing financial inclusion, the benefits and challenges associated with their adoption, and the future prospects of a more inclusive digital financial ecosystem.

Understanding Digital Payments

What Are Digital Payments?

Digital payments refer to financial transactions conducted electronically through digital platforms without the need for cash or physical checks. They include various modes such as:

- Mobile wallets (e.g., Google Pay, Paytm, Apple Pay)

- Internet banking

- Credit and debit cards

- QR code-based payments

- Cryptocurrency transactions

- Unified Payments Interface (UPI)

- Contactless payments (Near Field Communication – NFC technology)

Evolution of Digital Payments

Digital payments have undergone significant evolution in recent years, driven by technological advancements, government initiatives, and changing consumer preferences. The global shift toward cashless economies has accelerated, with digital transactions becoming the preferred mode of financial exchange.

Key milestones in digital payments include:

- Introduction of electronic fund transfers (EFT) in the 1970s

- Advent of internet banking in the 1990s

- The rise of mobile wallets and fintech companies in the 2010s

- Expansion of blockchain-based transactions and decentralized finance (DeFi) in the 2020s

The Role of Digital Payments in Financial Inclusion

Defining Financial Inclusion

Financial inclusion refers to the accessibility and availability of financial services to individuals and businesses, particularly underserved and unbanked populations. It aims to provide affordable and secure financial products such as savings accounts, credit, insurance, and remittances.

How Digital Payments Foster Financial Inclusion

1. Bridging the Gap for the Unbanked

One of the biggest challenges in financial inclusion is the lack of traditional banking infrastructure in remote and rural areas. Digital payments allow individuals to access financial services using mobile phones, even without a physical bank branch.

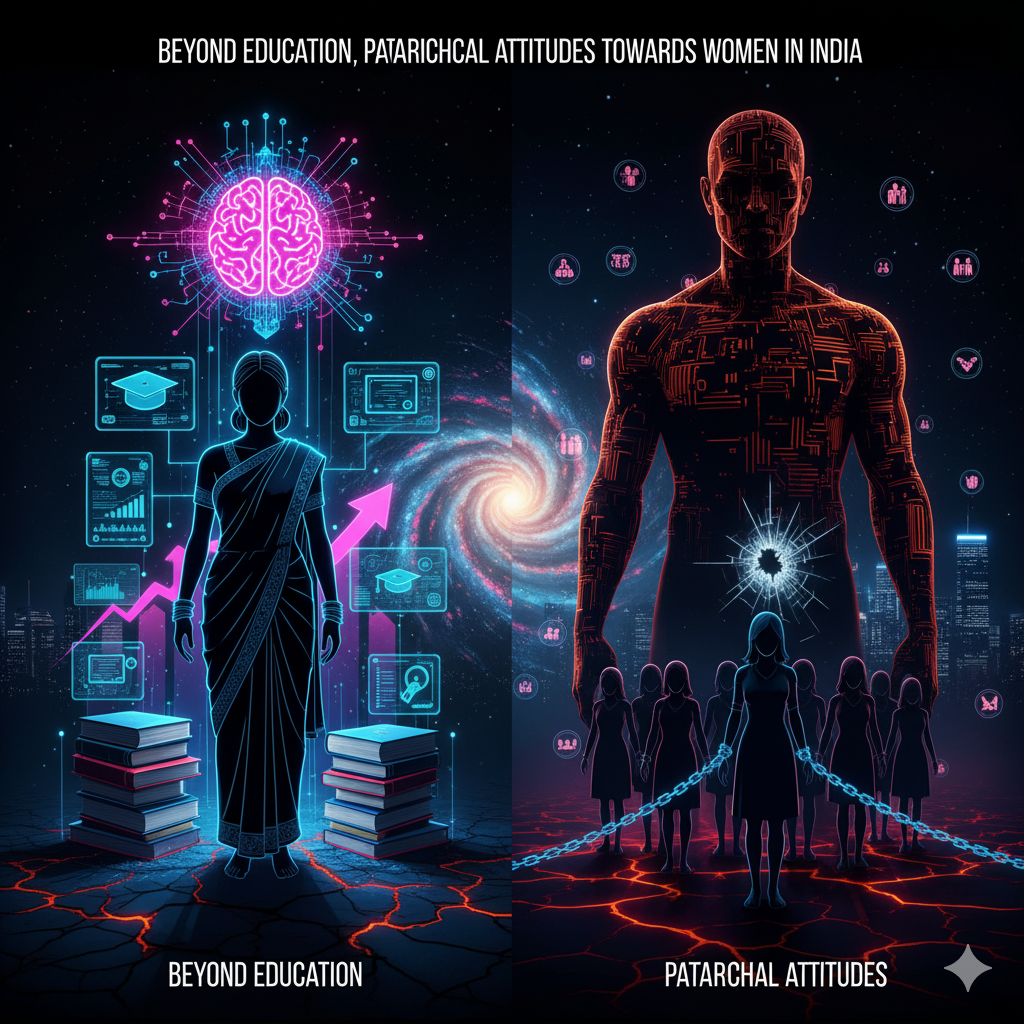

2. Enhancing Accessibility for Women and Marginalized Communities

Women and low-income groups often face barriers to financial inclusion due to societal and economic constraints. Digital wallets and fintech solutions provide them with direct control over their finances, promoting economic empowerment.

3. Reducing Transaction Costs

Traditional banking services often involve high operational costs, which discourage low-income individuals from participating in the financial system. Digital transactions are cost-effective, making financial services more affordable.

4. Boosting Small and Medium Enterprises (SMEs)

Small businesses and entrepreneurs benefit from digital payments through easy access to online banking, digital loans, and seamless transactions. This facilitates business growth and economic expansion.

5. Government Initiatives and Direct Benefit Transfers (DBT)

Governments worldwide use digital payment systems to distribute subsidies, pensions, and financial aid directly to beneficiaries, ensuring transparency and reducing corruption.

Challenges of Digital Payments in Financial Inclusion

Despite the advantages of digital payments, several challenges hinder their widespread adoption.

1. Digital Divide and Internet Connectivity Issues

Access to digital payment platforms is limited in areas with poor internet connectivity and lack of digital literacy.

2. Cybersecurity and Fraud Risks

Digital transactions are vulnerable to cyberattacks, identity theft, and online fraud, discouraging users from adopting digital payment methods.

3. Regulatory and Compliance Issues

Different countries have varying regulatory frameworks for digital payments, leading to compliance challenges for fintech companies and financial institutions.

4. Limited Financial and Digital Literacy

A significant portion of the population lacks awareness of digital payment methods, leading to hesitation in using such services.

5. Interoperability Issues

Many digital payment platforms operate in isolation, creating inefficiencies in fund transfers and limiting their adoption across different systems.

The Future of Financial Inclusion Through Digital Payments

As digital payments continue to evolve, the future of financial inclusion looks promising with new innovations and policies aimed at improving accessibility and security.

1. Artificial Intelligence (AI) and Machine Learning

AI-powered chatbots, fraud detection systems, and personalized financial recommendations can enhance digital financial services and increase user trust.

2. Blockchain and Cryptocurrency

Blockchain technology ensures transparency and security in transactions, while decentralized finance (DeFi) platforms offer innovative financial solutions beyond traditional banking.

3. 5G and Internet Expansion

The rollout of 5G technology will improve internet connectivity, enabling faster and more secure digital transactions, especially in rural areas.

4. Government and Private Sector Collaboration

Public-private partnerships can drive digital infrastructure development, regulatory improvements, and awareness programs to boost financial inclusion.

5. Biometric and Contactless Payment Innovations

The integration of biometric authentication, such as fingerprint and facial recognition, can enhance the security and convenience of digital payments.

Conclusion

Digital payments have revolutionized the financial sector, providing an inclusive platform for individuals and businesses worldwide. By addressing existing challenges and leveraging technological advancements, digital financial services can bridge the financial gap and empower underserved populations.

The future of financial inclusion depends on continued innovation, regulatory support, and public-private collaboration to create a seamless, secure, and accessible digital financial ecosystem.