Introduction

India is geologically blessed with abundant mineral resources due to its ancient origins as part of the supercontinent Gondwana. The Gondwana landmass, which existed around 600 million years ago, broke into fragments that now constitute present-day South America, Africa, Antarctica, Australia, and the Indian subcontinent. This supercontinent was rich in mineral wealth, particularly coal, iron ore, manganese, bauxite, and other non-ferrous and ferrous metals.

India inherited a significant share of this mineral wealth, and the Gondwana coalfields are among the most important energy resources in the country. In theory, such a geological advantage should make mining one of the pillars of India’s economy. Yet, paradoxically, the mining sector contributes less than 2.5% to India’s GDP (around 2024 estimates), which is disproportionately low when compared with other resource-rich nations.

This article explores the reasons behind the low GDP contribution of India’s mining industry, despite its Gondwana legacy, and critically examines the challenges, structural bottlenecks, and policy issues that undermine the potential of this sector.

Mining in India: A Brief Background

Historical Perspective

- Mining in India dates back to the Harappan civilization, where copper, gold, and semi-precious stones were mined.

- During the colonial era, mining was expanded but primarily served the interests of British industries. Coal, iron ore, and mica were extracted in large quantities, but little attention was paid to local industrialization.

Current Status

- India is one of the top producers of coal, iron ore, bauxite, limestone, and mica globally.

- The country holds the 5th largest coal reserves in the world and is also a major producer of chromite and manganese.

- Despite these facts, the sector’s share in India’s GDP has stagnated, contributing only 2–2.5%, while countries like Australia (around 7%), South Africa (8%), and Chile (10% from copper) derive a much higher percentage of GDP from mining.

Why Is the Contribution of Mining to India’s GDP So Low?

1. Policy and Regulatory Challenges

- Over-regulation and Bureaucracy: India’s mining industry is heavily regulated under laws like the Mines and Minerals (Development and Regulation) Act (MMDR). Multiple approvals, clearances, and licenses slow down project implementation.

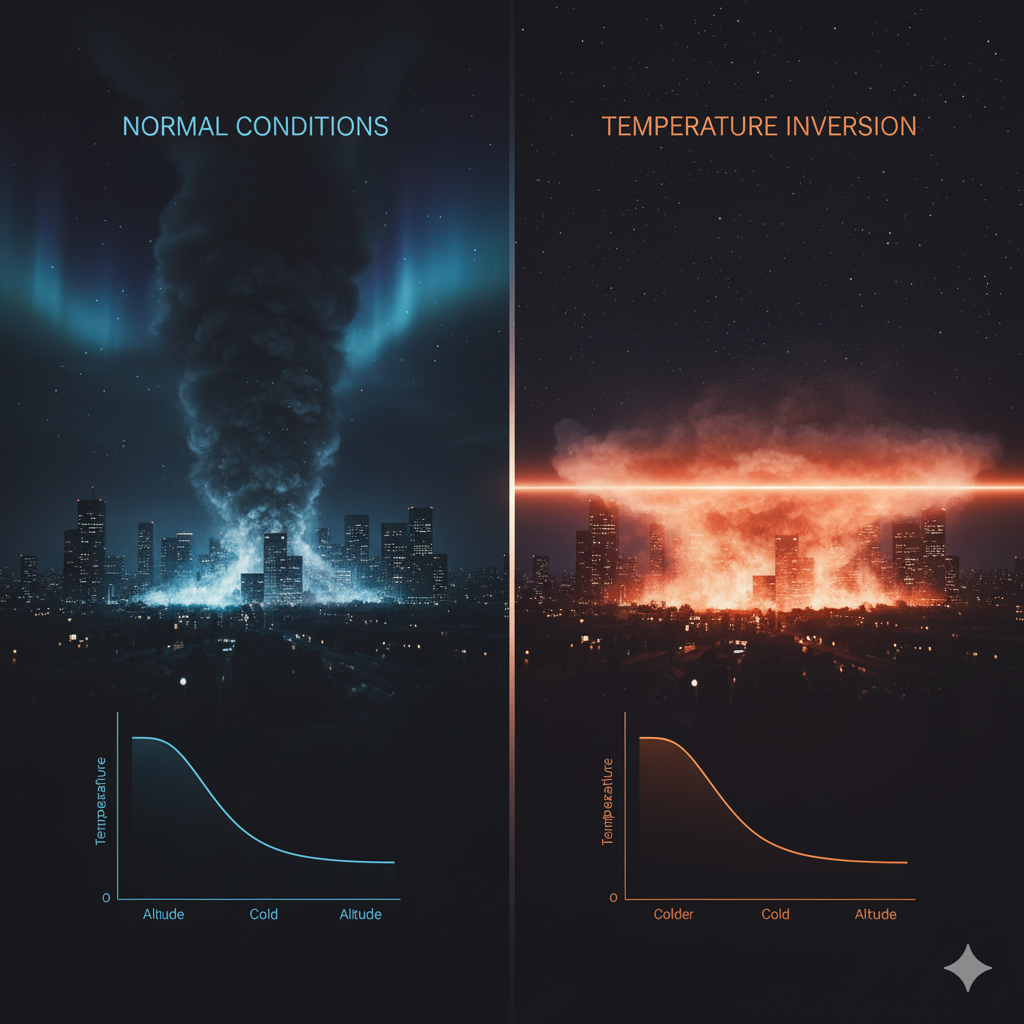

- Delays in Environmental Clearances: Mining projects often face years of delay in getting environmental and forest clearances. While environmental protection is necessary, excessive red tape discourages investment.

- Policy Uncertainty: Frequent changes in mining laws and royalty structures create uncertainty for investors.

2. Underutilization of Resources

- Large portions of India’s mineral wealth remain unexplored. Only about 10% of the Obvious Geological Potential (OGP) area has been explored in detail.

- Advanced exploration techniques such as deep-sea mining, satellite-based surveys, and 3D geological mapping are underutilized.

- Compared to countries like Australia, where detailed geological mapping has covered 80% of the land, India lags significantly.

3. Dominance of Coal and Neglect of Other Minerals

- Mining in India is overly dependent on coal, which contributes over 70% of mineral value production.

- Non-coal minerals like rare earths, gold, and copper are underexplored, despite rising global demand for critical minerals needed in electronics, renewable energy, and defense.

- This imbalance reduces the diversity of mining’s contribution to GDP.

4. Technological Backwardness

- Indian mining still relies heavily on open-cast, manual, and semi-mechanized methods.

- Lack of automation, digital mining, and efficient machinery reduces productivity.

- Safety standards are also weak, discouraging large-scale mechanized investment.

5. Infrastructural Bottlenecks

- Poor transport and logistics infrastructure limits the efficient evacuation of minerals.

- Many mines are located in remote tribal and forest areas where road and rail connectivity is inadequate.

- High transport costs reduce competitiveness in global markets.

6. Environmental and Social Issues

- Mining often takes place in ecologically fragile areas such as forests and tribal regions. This creates conflict between environmental protection, tribal rights, and industrial needs.

- Land acquisition remains a major hurdle. Local resistance, displacement, and rehabilitation issues slow down projects.

- Increasing judicial activism has also led to the suspension of several large mining operations, such as the iron ore mining ban in Karnataka and Goa.

7. Illegal and Unscientific Mining

- Illegal mining of coal, sand, and iron ore is rampant. This leads to revenue losses and environmental degradation.

- Unscientific practices reduce efficiency, cause wastage of resources, and harm local communities.

8. Low Value Addition

- India mainly exports raw ores instead of processed or value-added mineral products.

- For example, bauxite is exported instead of being fully processed into aluminum domestically.

- This reduces the sector’s overall GDP contribution compared to countries that focus on mineral-based industries.

9. Global Competition

- Indian mining faces competition from countries with cheaper and more efficient mining operations, such as Australia, Brazil, and South Africa.

- High royalty rates and levies in India make mining less attractive compared to global peers.

Comparative Perspective: Why Other Gondwana Countries Perform Better

- Australia: Uses advanced exploration and technology, invests heavily in R&D, and has stable mining policies. Mining contributes ~7% of GDP.

- South Africa: Despite socio-political challenges, mining contributes about 8% of GDP, mainly from gold, platinum, and diamond exports.

- Brazil: Rich in iron ore and bauxite, with strong export orientation, mining contributes significantly to its economy.

India, by contrast, remains underexplored, over-regulated, and environmentally contested, which holds back the sector’s full potential.

Socio-Economic Implications of Low Mining Contribution

- Loss of Revenue – India imports expensive minerals like gold, copper, and lithium while underutilizing its own reserves.

- Employment Potential Wasted – Mining has the capacity to generate large-scale direct and indirect employment in rural areas, but this potential remains untapped.

- Energy Dependence – Despite huge coal reserves, India continues to import coal for power generation due to inefficiency in mining and transport.

- Regional Inequalities – Mineral-rich states like Jharkhand, Odisha, and Chhattisgarh remain underdeveloped due to poor mining governance and lack of industrialization.

Recent Government Initiatives

The Government of India has taken several steps to revive the mining sector:

- MMDR Amendment Act (2015, 2021): Introduced transparent auction of mineral blocks.

- National Mineral Policy 2019: Emphasizes exploration, private participation, and sustainable mining.

- Commercial Coal Mining (2020): Allowed private players to enter coal mining, ending the monopoly of Coal India Limited.

- District Mineral Foundation (DMF): Created to share mining revenues with local communities.

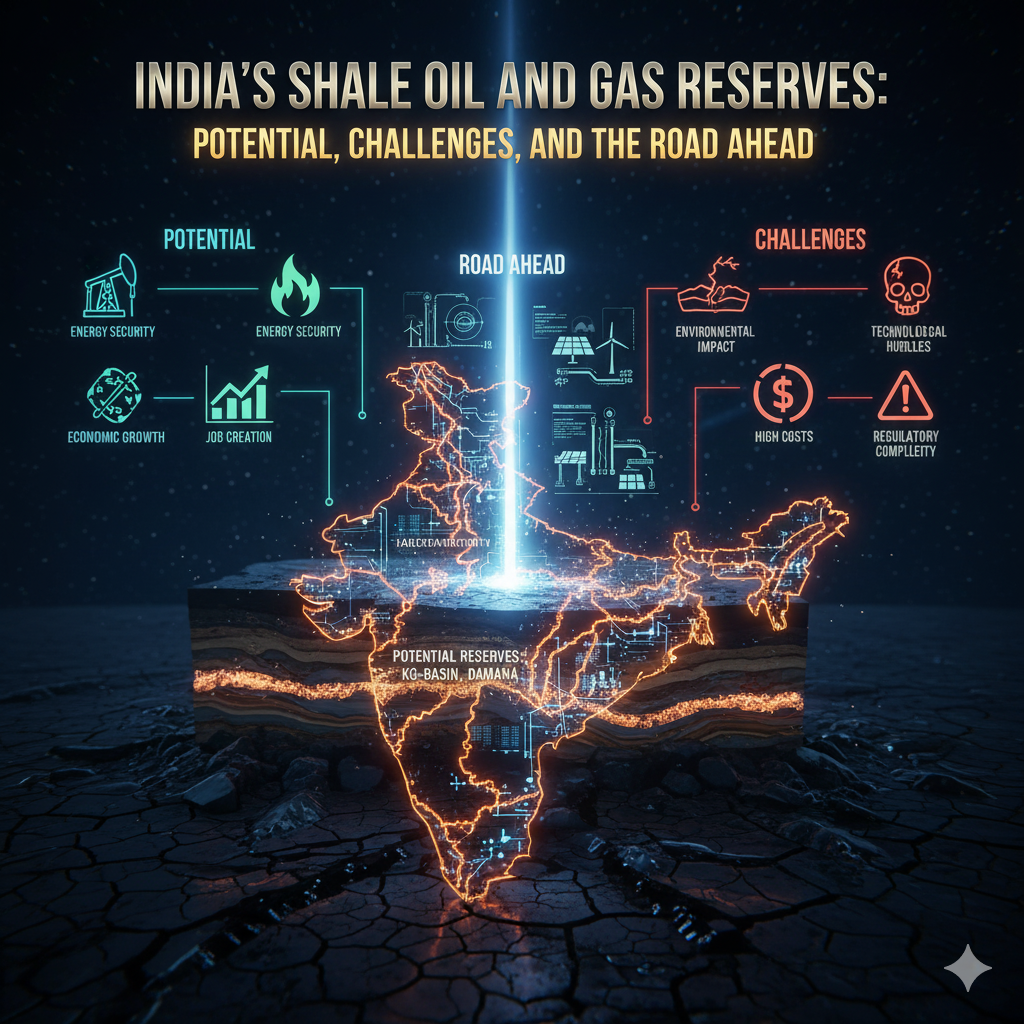

- Critical Minerals Strategy (2023): Focus on exploration of lithium, cobalt, and rare earths.

While these initiatives are steps in the right direction, effective implementation remains a challenge.

The Way Forward

For mining to play a greater role in India’s GDP, several reforms and strategies are needed:

1. Strengthening Exploration

- Invest in advanced exploration technologies like geospatial mapping, deep-sea exploration, and AI-based predictive modeling.

- Encourage public-private partnerships in exploration.

2. Policy Stability and Transparency

- Simplify clearance processes while balancing environmental concerns.

- Ensure stable royalty structures and long-term policy frameworks.

3. Technological Modernization

- Promote mechanized and digital mining.

- Invest in sustainable technologies to minimize environmental damage.

4. Value Addition and Downstream Industries

- Develop processing industries like aluminum smelters, steel plants, and battery manufacturing units domestically.

- Reduce dependence on raw mineral exports.

5. Infrastructure Development

- Improve rail and road connectivity to mining belts.

- Create dedicated mineral corridors for efficient transport.

6. Environmental and Social Balance

- Implement responsible mining practices with minimal displacement.

- Strengthen rehabilitation and compensation mechanisms.

- Encourage community participation in decision-making.

7. Curb Illegal Mining

- Strengthen monitoring with satellite imaging and digital tracking of mineral transport.

- Enforce stricter penalties for illegal operators.

Conclusion

India’s geological heritage as part of the Gondwana supercontinent has endowed it with vast mineral resources. Yet, paradoxically, mining contributes much less to the country’s GDP than expected. The reasons are manifold: over-regulation, technological backwardness, infrastructural bottlenecks, environmental conflicts, and underutilization of resources.

Unlike countries such as Australia, South Africa, or Brazil, India has not fully capitalized on its mineral wealth due to governance and policy challenges. If India reforms its exploration, invests in technology, ensures policy stability, and strikes a balance between environment and development, the mining sector could emerge as a far more significant contributor to national income.

The future of India’s mining lies in responsible, technology-driven, and community-oriented practices that not only enhance GDP contribution but also ensure sustainability and equity.