Introduction

Money is one of the most fundamental inventions of human civilization. It is the lifeblood of economic activities and serves as the medium through which individuals, businesses, and governments interact in markets. In its simplest form, money is anything that is generally accepted as a means of exchange, a unit of account, a store of value, and a standard of deferred payments.

In ancient times, barter was the main method of exchange, where goods and services were traded directly. However, barter had serious limitations, such as the problem of double coincidence of wants and lack of a common measure of value. To overcome these challenges, money emerged in various forms—metallic coins, paper currency, and today, digital and electronic currencies.

In modern economies, money is not just currency in circulation but also includes deposits and other financial instruments. In India, the Reserve Bank of India (RBI) has adopted multiple classifications of money supply to better understand liquidity conditions and to frame appropriate monetary policies.

This essay will explain:

- The meaning, features, and functions of money.

- Evolution of money in India.

- The measures of money supply in India (M1, M2, M3, M4).

- Importance of these measures in policymaking.

- Challenges in measuring money supply.

1. Meaning and Nature of Money

Economists define money not just as cash or coins but as any asset that performs certain critical functions in an economy.

Definition of Money

- According to Crowther: “Money is anything that is generally accepted as a means of exchange and that at the same time acts as a measure and store of value.”

- According to the RBI: Money includes currency and deposits that are readily accepted for transactions.

Thus, money is not confined to notes and coins; it also includes demand deposits in banks, which can be quickly converted into cash or used directly through cheques, UPI, or debit cards.

2. Functions of Money

Money performs four major functions that make it indispensable in modern economic life:

(a) Medium of Exchange

- The most important role of money is to facilitate the exchange of goods and services.

- Without money, people would have to rely on barter, which is inefficient.

- Example: When you buy groceries by paying ₹1,000, you are exchanging money for goods.

(b) Measure of Value (Unit of Account)

- Money provides a common standard to measure and compare the value of goods and services.

- Example: A book costs ₹500, while a mobile costs ₹15,000. Without money, comparing these values would be complex.

(c) Store of Value

- Money can be saved and used in the future.

- Unlike perishable goods (like food), money retains its value over time and allows people to postpone consumption.

(d) Standard of Deferred Payments

- Money allows people to enter into contracts and transactions that will be settled in the future.

- Example: Home loans, car loans, or government bonds all rely on money as a standard of deferred payments.

3. Characteristics of Money

For an object to function effectively as money, it must possess certain features:

- General Acceptability – It must be widely recognized as a medium of exchange.

- Portability – Money should be easy to carry and use.

- Durability – Money should not perish quickly.

- Divisibility – It should be divisible into smaller units for convenience.

- Uniformity – Units of money must be identical (₹100 note must have the same value everywhere).

- Stability of Value – It should retain purchasing power over time.

4. Evolution of Money in India

- Barter System (Ancient times) – Exchange of goods directly.

- Metallic Money (Coins) – Gold, silver, and copper coins were in circulation in the Mauryan and Gupta periods.

- Paper Currency (Colonial period) – The British introduced paper notes in the 18th–19th century.

- Bank Money – Deposit accounts, cheques, and drafts became popular.

- Electronic Money – Debit/credit cards, UPI, e-wallets, and now CBDC (Central Bank Digital Currency or e-Rupee).

This historical journey shows how money in India adapted to changing economic needs.

5. Money Supply in India

Money supply refers to the total stock of money available in an economy at a given point of time. It includes not just cash in circulation but also demand deposits and other liquid financial instruments.

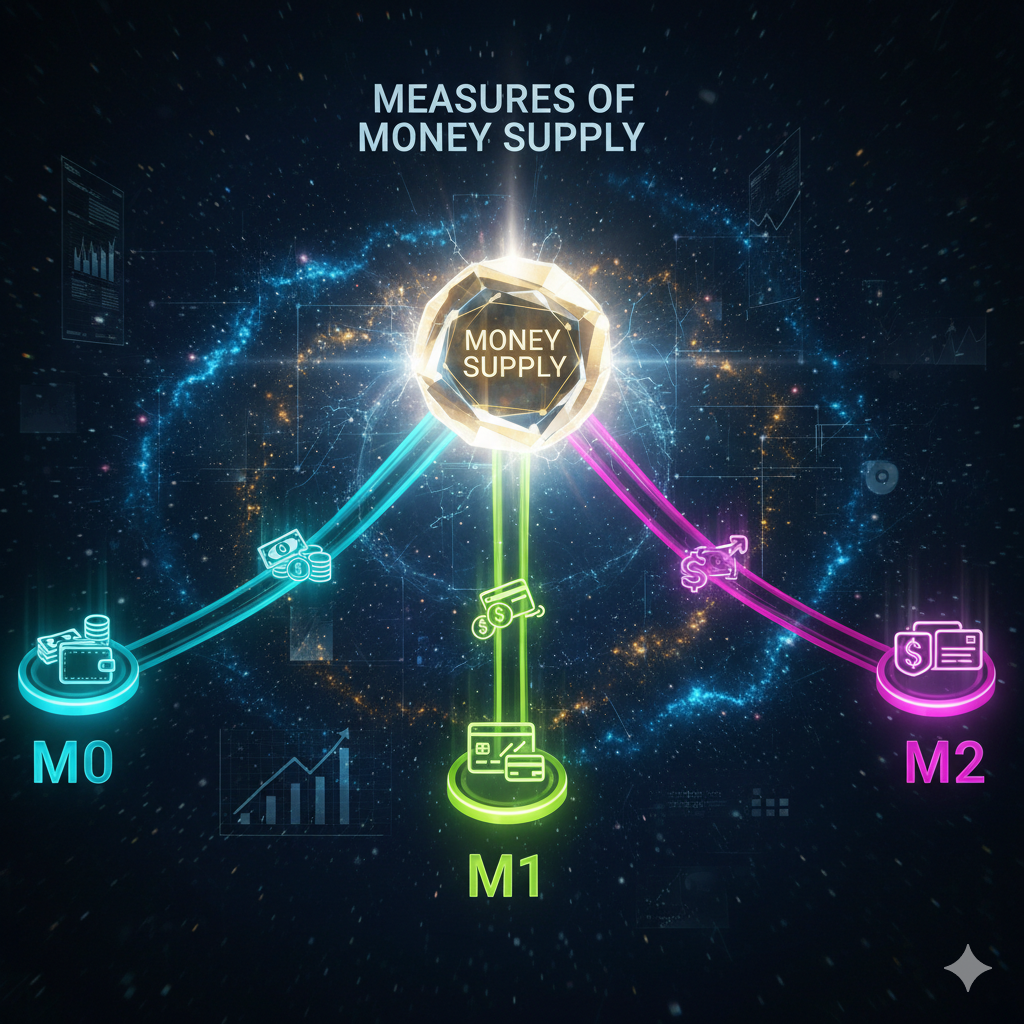

In India, the Reserve Bank of India (RBI) classifies money supply into four categories: M1, M2, M3, and M4. This classification is based on liquidity, i.e., how quickly an asset can be converted into cash.

5.1 Narrow Money (M1)

M1 is considered the most liquid form of money. It is also called transaction money because it is readily available for use.

Components of M1:

- Currency with the Public (notes + coins).

- Demand Deposits with Banks (savings/current accounts).

- Other Deposits with RBI (such as deposits of foreign governments, financial institutions, etc.).

💡 Example: If you pay via UPI from your savings account, that is part of M1.

5.2 M2

M2 includes all components of M1 plus savings deposits with post offices.

Components of M2:

- M1 + Post Office Savings Deposits.

This measure is important in India because post office savings still form a significant portion of household savings, especially in rural areas.

5.3 Broad Money (M3)

M3 is the most commonly used measure of money supply in India and is also known as the aggregate monetary resource of the economy.

Components of M3:

- M1 + Time Deposits with Banks (fixed deposits, recurring deposits, etc.).

M3 is used by the RBI as the benchmark measure for monetary policy because it reflects the total money available for consumption and investment.

5.4 M4

M4 is the broadest measure of money supply.

Components of M4:

- M3 + Total Deposits with Post Offices (excluding National Savings Certificates).

M4 is not as frequently used as M3 in monetary policy but provides a wider picture of total liquidity.

6. Importance of Measuring Money Supply

Measuring money supply is crucial for economic stability and growth:

- Formulating Monetary Policy – RBI uses money supply data to control inflation and ensure economic stability.

- Inflation Control – Excess money supply can cause inflation, while shortage can cause deflation.

- Growth Monitoring – Helps assess the pace of economic growth.

- Investment Decisions – Guides businesses and investors about liquidity conditions.

- Financial Inclusion – Helps track whether people in rural areas are part of the banking system.

7. Recent Developments in India’s Money Supply

- The growth of digital payments (UPI crossed billions of monthly transactions).

- Introduction of e-Rupee (CBDC) in pilot phases.

- Decline in the use of physical cash in urban areas.

- Rising share of time deposits (FDs, RDs) in total money supply.

8. Challenges in Measuring Money Supply

- Shadow Economy – Unrecorded transactions make it difficult to estimate.

- Black Money – Hidden wealth not captured in official records.

- Digital Innovations – Rise of e-wallets, cryptocurrencies, and fintech complicates definitions.

- Cash Dependency – Despite digital progress, India remains a high-cash-usage economy.

9. Conclusion

Money is not merely coins and currency but the foundation of all modern economies. Its role as a medium of exchange, measure of value, store of wealth, and standard of deferred payments makes it indispensable.

In India, the Reserve Bank of India measures money supply through four aggregates: M1, M2, M3, and M4. Among these, M3 is the most widely used for policy purposes. Understanding these measures is critical because they influence inflation, growth, investments, and overall economic stability.

As India transitions into a digital-first economy, the nature of money is also evolving—from cash and deposits to UPI, digital wallets, and e-Rupee. The ability of policymakers to accurately measure and manage money supply will determine the success of India’s economic growth in the 21st century.